|

Understanding through Discussion |

|

|

Register | Sign In |

|

QuickSearch

| EvC Forum active members: 65 (9164 total) |

|

| |

| ChatGPT | |

| Total: 916,422 Year: 3,679/9,624 Month: 550/974 Week: 163/276 Day: 3/34 Hour: 0/1 |

| Thread ▼ Details |

|

Thread Info

|

|

|

| Author | Topic: The Giant Pool Of Money. Implications | |||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

The problem is lack of consensus. No, the problem is the need for consensus. It shouldn't work like that - elections should matter. Politicians should put their policies before the voters, the voters decide, and then the party that won gets to rule. If people don't like the results there's always the next election. The party that wins elections shouldn't need the permission of the losers to rule. That means that elections don't matter. Maybe to amend the Constitution or do other incredibly permanent, long-term things; but regular legislation can't ever be "tyranny of the majority" so why should it be subject to minority rule?

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

If gold or silver were backing the currency no politiiton could purposely inflate the system for political epediency. Precious things like gold and silver can't be eaten, but they, for sure, do not inflate. They inflate every time someone opens a gold or silver mine, Buz. Indeed the historical record presented to you indicates that there's more inflation on gold or silver money than on fiat currency. The worst inflation England ever had was around 1600, when France started smuggling silver into the country. At first glance, that sounds insane! It's like sneaking 50 dollar bills into your enemy's pocket. But it rapidly debased the pound sterling (sterling silver) to such an extent that the Crown hired Issac Newton, the smartest man in England at the time, to deal with it.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

In the UK at the moment we have low growth, low interest rates and (relatively) high inflation. This seems like a potentially problematic combination. It's called a "liquidity trap". Your central bank has hit the zero bound on interest rate discounting; it just can't loan money much cheaper than it's loaning it, now. That said I'm not sure you have "real" inflation; I think you have the same kind of fake inflation in the CPI that Buz is on about. The price of oil underlies the price of a lot of other things - food, plastic items, anything that has to be manufactured using energy or transported via fossil fuels. Since wage growth isn't very high in the UK I suspect your suddenly-higher rate of "inflation" just reflects a Consumer Price Index over-weighted towards oil-derived prices. Or it could be "stagflation", which economists still aren't too clear about.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined:

|

Commodities are not fiat legal tender/currency. Precious metals are and always have been; they have no intrinsic worth because they have little intrinsic utility. By definition they're a fiat currency whose value, instead of being set by a central bank charged with regulating the economy, is set instead by narrow, parochial mining outfits interested only in making money and thereby inflating your currency. On a metals standard, your currency inflates every time someone opens a mine.

Paper money which has historically been swept up in streets after inflating into oblivion cannot always necessarily be traded for silver. If there's silver to buy, money can always buy it. But not everybody wants to buy silver. There's not much of a market for giant stone wheels, these days. You certainly couldn't argue that they were paper money, but the value of giant stone wheel currency plummeted when Irish sailors started importing wheels to the Island of Yapp. All currencies can inflate, even gold-backed dollars. Historically gold-backed dollars inflated even faster than today's fiat dollars. We proved it.

It has, historically, always considered precious, having non-corrosive beauty, durability and commercial use. Money has always been considered precious and been of commercial use. Money has enduring value simply because of its role as currency. Hence, numismatics.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

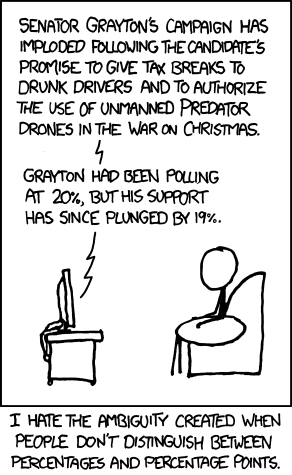

Do you disagree that it will occur? Well, it depends. And I would simply point out that to go from our current inflation rate back to the "normal" GDP-growth positive inflation rate would be something on the order of a 300% increase in the rate of inflation.  There's a fair bit of ambiguity in talking about the percentage of increase of a first-order derivative (expressed as a percentage) of the US price level.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

I don't believe there is a serious argument that gold and silver are not useful beyond their ornamental uses. I didn't make such an argument, and I was very aware of all of those uses for gold and silver when I said:

quote: You'll notice, hopefully, that what I said was "little", not "none."

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Those metals are of great value even if we exclude purely ornamental uses. We're arguing a matter of degrees, "little" vs "great." The point was that the metals have little intrinsic value for coinage aside from scarcity; sure, they're ductile and resistant to tarnish but so are titanium and aluminum and zinc. They're chosen as currency metals simply by tradition; their value in a coin is as much a function of fiat as paper money. There's no more inherent value in a gold coin than a dollar bill. Unless you're looking for raw materials to make jewelry or plate conductors. But most people aren't; the basic use case for a gold coin is as a coin, not melted down for industrial use.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

People didn't rush out to California because they could mint coins. No, they thought they could sell the gold to people who would coin it. The California gold rush certainly wasn't driven by gold's industrial value. It was driven by gold's value as currency - as something widely considered valuable.

And of course essentially no 'regular folks' in the US uses gold coins for anything other than collecting and hoarding. You cannot spend gold igots. That's what I'm getting at. People who hoard gold hoard it not because of its industrial demand, but because of its monetary demand. Buz thinks that gold is a hedge against fiat currency. But gold is also a fiat currency. Nobody hoards gold because they think that when the dollar crashes, people will pay big for something to make false teeth out of.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Base the dollar on what people do. What makes you think its not, already? That's why we have a fiat currency. The value of a dollar is the value of all the things you can buy with dollars, which basically does average it out. And why on Earth would we want to stop inflation? Inflation is a good thing. In part, inflation is how we make sure there's enough dollars to go around as the American population grows. Inflation drives investment. Inflation is a good thing!

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Inflation amongst the citizenry seems to them like their money is going down the drain. The "citzenry" doesn't have any money, for the most part, but what's in their pockets. They have assets that earn a positive return (like bank accounts or stocks), debts that inflation effectively shrinks, and the future value of their labor which will increase in price as inflation proceeds. Inflation is a great thing for the citizenry, at manageable levels, because it deleverages them out of debt and increases the price they can command for their labor and goods. The people who care about inflation are the people who hold enormous sums of money. Scrooge McDuck cares about inflation; the citizenry are afraid of it for all the wrong reasons. Because they think of themselves as owning mostly money, when in fact, they own mostly assets, labor, and debt.

Stockbrokers do ABSOLUTELY NOTHING OF REAL VALUE for this country, ABSOLUTELY NOTHING OF REAL VALUE for you and YET, YET, they get paid BIG BUCKS for it. I have absolutely no argument with you on that. Most financial transactions are just taking money with the right hand and handing it off with the left (with a nice little piece kept in the middle.) But I'm not talking about stock brokers, I'm talking about making capital investments in businesses. That's actually a good thing - it reduces the barriers to competition, to starting new businesses, because an entrepreneur doesn't have to already be independently wealthy to start a business. He can get a loan, sell shares, and have others invest in his business. Finance makes that possible. It also makes an enormous amount of grift possible, I don't deny that. But don't miss the forest for a few of the rotten trees.

The USA needs George Bailey so bad, because we are still lurching down the road to Potterville. Well, right, but remember what George Bailey actually was - a banker. He ran a credit union. He took money with his left hand and handed it off with his right, so that old lady what's-her-name could have an appreciating asset in which to invest her money and grow it above inflation, and the Italian family could take out a mortgage to buy a home. That's what finance makes possible. Are the lessons ignored? More Americans than ever are choosing to bank with local credit unions. I think people are starting to take that movie to heart more than ever. But try not to forget that It's A Wonderful Life, at its heart, is about a man who is a hero because he sells collateralized debt obligations based on subprime mortgages. Edited by crashfrog, : No reason given.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Thus the stability of monetary systems which have backed promissory notes, i.e. bills, by silver and gold. How do you figure "stability", Buz? Every time they mine some silver, it inflates any silver note currency. Last year they mined almost a billion troy ounces of silver. Gold is even worse. Anybody can go in and mine some silver, Buz. The US dollar has the major advantage that the only source of them is the Federal Reserve Bank.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined:

|

Mmm, Crashfrog. Anybody? How and where? This will blow your mind: with shovels, right out of the goddamn ground.

What are you waiting for???? What am I waiting for for what?

How come there's never, in human history, been enough gold and silver to render it as value-less as paper? Because its easier to cut down a tree than mine silver. And I wouldn't say paper is "valueless"; when I print on campus I have to pay 9 cents a page. Part of that is the toner but most of that is the paper.

There has never been enough to depreciate its value. Don't you ever get tired of being wrong, Buz? Look at the historical value of silver:

In the long term silver has never done anything but inflate and lose value, because we keep mining it. And it basically never goes away; now that we don't use film anymore there's basically zero significant non-recyclable silver applications. Seriously, Buz. Why don't you look things up before you say the complete opposite of what is true? Edited by Adminnemooseus, : Make graphic a bit smaller.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Some of the information that I have been reading and pondering suggests that inflation is inevitable. In fact, many predict inflation that will not only be double digit, but will approach 100% for two or three years straight. "Many"? Who, Phat? Name even one credible economist who is predicting that US inflation will hit an incredibly ahistorical 100% any time in the next ten years based on current policy. And what would be the basis for this inflation, when the US has ample unused production capacity? What the fuck are you even talking about?

Crashfrog, I know you think inflation is a good thing Well, to be fair - and I don't see how you can get this so wrong after I've so patiently explained it to you - I think something on the order of a 4-5% inflation rate is a good thing. That's the opinion universally shared by economists. Now, for the most part economists are witch doctors, but I take their opinions slightly more seriously than random people on the internet. I see that you've decided to join Buzsaw by doing the exact opposite.

Inflation will approach 100% within 5 years and will destroy the remaining wealth of the US Middle Class, (though perhaps it may help pay much of the debt) It's almost the new year so lets say that 5 years from now is January 2017. The CPI increase rate for 2017 would be out in, say, March? I'll bet you $100 inflation-adjusted 2017 dollars that the annual American inflation rate over the next 5 years doesn't rise above 12%. Bet?

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined:

|

Hey Phat, hey, everybody.

So I had the reminder for this bet set on my phone, but I couldn't remember what it was about so I popped in here to try to remind myself. Imagine my luck that Phat had himself promoted the thread! And then RAZD mentioned the gambling thing and so I just wanted to pop in and say that I certainly have no intention of collecting on the bet; honestly the "I told you so" is all the payment I would ever need, right? And in truth I'm much more interested in the post-mortem. Phat, would you like to take a stab at assessing the predictive powers of five-years-ago you? I can appreciate that trying to reconstruct past mental states is difficult - I often look at the wardrobe choices of five-years-ago me and struggle to recollect what the hell I was thinking. But I'd be interested if you would care to hazard a guess as to why things turned out my way rather than yours. I'm glad our bet wasn't about who the president would be, though. Holy shit.

|

|||||||||||||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

I'm not here to stay, just thought I'd check in, maybe hang for a day or two. I'm active on Twitter and Reddit, though.

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

Do Nothing Button

Copyright 2001-2023 by EvC Forum, All Rights Reserved

™ Version 4.2

™ Version 4.2

Innovative software from Qwixotic © 2024