|

Understanding through Discussion |

|

|

Register | Sign In |

|

QuickSearch

| EvC Forum active members: 64 (9163 total) |

|

| |

| ChatGPT | |

| Total: 916,419 Year: 3,676/9,624 Month: 547/974 Week: 160/276 Day: 0/34 Hour: 0/0 |

| Thread ▼ Details |

|

Thread Info

|

|

|

| Author | Topic: Replacing Consumerism | |||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Yeah, that's true. But advances in technology mean that you can heat the same sized home with less power; that a larger home retains heat better than a smaller one (that's just a function of geometry), that you can have fixtures that use less water, and so on.

And, necessarily, some people are going to respond to a lower per-unit cost by consuming more units. Is that "consumerism" or, again, people just maximizing their value for the dollar?

|

|||||||||||||||||||||||||||||||||

|

Jon Inactive Member |

But now it sounds like your problem isn't with consumerism per se, you just think some people should consume more and others should consume less. So, you're less concerned with the overall level of "consumerism" and more concerned with its distribution. Consumerism isn't just the consumption of stuff. It's not just the transaction on the books, the acquisition of a Christmas gift. It is a beliefa mindset.

You can take a small subset of that and trivially observe that their income and consumption may not be identical, but that's only a function of the fact that you're looking at a subset of the whole. A subset which, of course, is still made up of human beings living under crushing debt. You may write it off as merely 'a function of the fact that you're looking at a subset of the whole', but others of us see it as a serious societal problem that needs a solution.

Rising home sizes don't a priori establish some putative increase in "consumerism." And I never said it does.

And any analysis of the rise in home sizes has to - has to - include the fact that it's cheaper to get a home at a certain size now than it was 50 years ago in today's dollars. Feel free to bring in those cost numbers so that we can figure out the effect they have on increased home size and rule them out of our calculations. JonLove your enemies!

|

|||||||||||||||||||||||||||||||||

|

Jon Inactive Member |

that a larger home retains heat better than a smaller one (that's just a function of geometry), that you can have fixtures that use less water, and so on. It depends on the way in which it is larger. But, feel free to bring in those numbers.Love your enemies!

|

|||||||||||||||||||||||||||||||||

Artemis Entreri  Suspended Member (Idle past 4250 days) Posts: 1194 From: Northern Virginia Joined: |

I don't see how consumerism is that bad, but I also don't think I know very many people who are consumerists.

Happiness for me is a bowl loaded with dank, and a 6lb largemouth on the line, as i sit in a chair on the lake. Sure I have a bunch of lures, hooks, plastics, and a few rods, but it's not because of my desire to buy fishing equipment, its because of my desire to catch fish.

|

|||||||||||||||||||||||||||||||||

|

ICANT Member Posts: 6769 From: SSC Joined: Member Rating: 1.6 |

Hi crash,

crashfrog writes: I think you hopelessly have no idea what you're talking about. I know I don't know what I am talking about. I consume less than my income. But the problem in America is just the opposite, most Americans consume more than their income. They buy cars they can't afford.They buy those large houses they can't afford. They buy all kinds of gadgets they don't need. They do all these things to keep up with the neighbors. We have a Government that consumes a lot more that it has income to cover and that is why we have a 15+trillion debt and rising by 4 billion dollars a day. The cure for the problem is for everyone to live within their means. In other words don't spend more than you make. There is nothing wrong with consumerism. The problem is the consumers, consuming more than they can afford. God Bless,"John 5:39 (KJS) Search the scriptures; for in them ye think ye have eternal life: and they are they which testify of me."

|

|||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

It is a beliefa mindset. Then I guess I need more than a single narrow trend in new home construction to explain what it is, exactly, that you think is on the rise, here. Do you really think that people in the 50's didn't derive significant satisfaction from owning a specific set of things? We're talking about a time when what it meant to be an American - the "American dream" - was defined by consumption and ownership.

A subset which, of course, is still made up of human beings living under crushing debt. Wait, which subset is this? I never defined such a subset. If you now want to talk about people living in crushing debt, that's fine, but then you need to grapple with the fact that those debts are crushing specifically because they're not "consumer" debts, but difficult-to-discharge debts like student loans, medical bills, and mortgages. Traditionally we don't interpret people wanting to get college degrees as "consumerism", but as people making investments in themselves and their own skills. Is that what you're talking about? And moreover debt doesn't change the equation! Those debts don't come out of nowhere; your debt is income which means that it's someone else's consumption - somebody spent some money so you could build a house or go to college. Now you're going to consume some money as an interest payment to service that debt, and that's going to be your creditor's income. Consumption always equals income because they're the same thing.

And I never said it does. So far that's been your sole evidence that there's something called "consumerism" which is on the rise and "causing all these problems." Look, Jon, I can't help you if you don't do your homework and actually explain what you're trying to say. What is "consumerism"? Why should we believe its "on the rise"? How is it the "cause" of our problems? In other words - why are you being so cagey about what, exactly, you're on about? You've clearly got a hard-on about this; why keep it such a fucking secret? You opened this thread to discuss it. So, discuss already.

|

|||||||||||||||||||||||||||||||||

|

ICANT Member Posts: 6769 From: SSC Joined: Member Rating: 1.6 |

Hi Jon,

Jon writes: but others of us see it as a serious societal problem that needs a solution. There is no problem as long as you do not spend more than you can pay for out of your income. The problem only exist when people spend money they don't have to spend. If I want something I simply ask the question, do I have enough money to pay for this item? Then I ask do I need this item? If the answer to both questions is yes, then I purchase the item. If the answer to either one is no, then I do not purchase the item. But I guess that comes from following the advice of Paul when he said: "without covetousness, content with such things as ye have, for he hath said, I will never leave thee, nor forsake thee". God Bless,"John 5:39 (KJS) Search the scriptures; for in them ye think ye have eternal life: and they are they which testify of me."

|

|||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

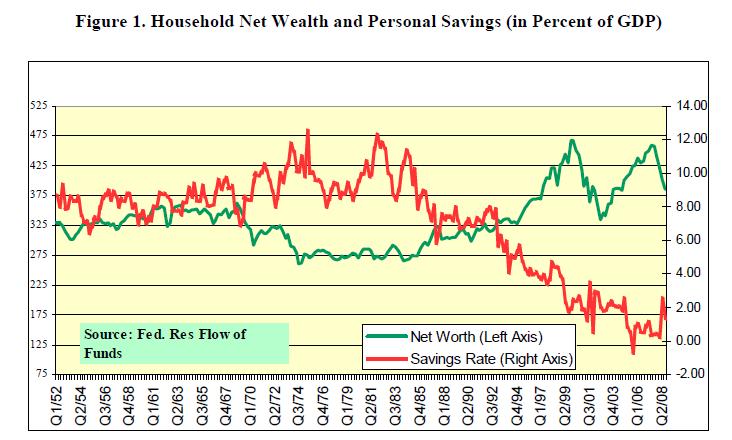

But the problem in America is just the opposite, most Americans consume more than their income. Well, no, that's not at all true. Americans spend less than their income:  We know this is true because Americans have maintained a positive savings rate for decades:  Now, clearly that rate is not now as high as it once was. But we're hardly in any sort of position where Americans consume "more than their income." Indeed, exactly the opposite - we're experiencing a recession entirely as a result of Americans consuming less of their income. Indeed you can see in the first chart how the personal savings rate dramatically increased in 2009 (a year not shown on the bottom chart.)

We have a Government that consumes a lot more that it has income to cover and that is why we have a 15+trillion debt and rising by 4 billion dollars a day. Well, sure. Overwhelmingly the Federal government is engaged in debt-financed wealth transfer from young people like me to old people like your buddy Buzsaw. All those guys who grew up in the 50's and were supposedly so personally responsible, unlike the spendthrift kids of today? They're the group that is overwhelmingly supporting a lavish lifestyle on the public dole. But somehow I guess its only "consumerism" when 25-year-olds spend their own money on iPhones, not when Buzsaw spends my tax dollars to maintain a lavish New York home.

|

|||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

Sure I have a bunch of lures, hooks, plastics, and a few rods, but it's not because of my desire to buy fishing equipment, its because of my desire to catch fish. Agreed, and I don't think you're particularly unusual in that regard; Americans own cars because they need them to get around. They buy iPhones because they want a cell phone that can also access the internet - the primary means by which Americans access the internet, these days, is by phone. They own large homes because that's what's available on the market for them to buy. Certainly status-signaling plays a role as well, but it always has. I don't see any indication that status-based spending is on the rise; indeed, most of the "status" brands of things were established in the supposedly "less consumerist" 40's, 50's, and 60's, during the post-war economic boom. Edited by crashfrog, : No reason given.

|

|||||||||||||||||||||||||||||||||

|

ICANT Member Posts: 6769 From: SSC Joined: Member Rating: 1.6 |

Hi Jon,

Jon writes: Read the chapter in my links. Crushing debt is one of the side-effects of consumerism, Crushing debt is the product of spending more money than you have income. The US Government spends 4 billion dollars a day more than they take in. That is why our debt is 15+ trillion dollars and rising. Our government has a spending problem. Americans have a spending problem. The only way to fix either is to stop spending more that you take in, or increase the income. God Bless,"John 5:39 (KJS) Search the scriptures; for in them ye think ye have eternal life: and they are they which testify of me."

|

|||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

The only way to fix either is to stop spending more that you take in, or increase the income. Or, both.

|

|||||||||||||||||||||||||||||||||

|

ICANT Member Posts: 6769 From: SSC Joined: Member Rating: 1.6 |

Hi crash,

crashfrog writes: But we're hardly in any sort of position where Americans consume "more than their income." Do you have any debt? If so you spend more than your income. Here is the latest figures for debt in America.

quote:Source quote:Source 6,000 bankruptcies per day is caused by people spending money they did not have and then not being able to procure the money to pay the debt with.

quote: It really looks like a huge spending problem to me. Simple solution is to live within your means. (not spend more than you make) Do you agree or disagree?

crashfrog writes: Source They're the group that is overwhelmingly supporting a lavish lifestyle on the public dole. But somehow I guess its only "consumerism" when 25-year-olds spend their own money on iPhones, not when Buzsaw spends my tax dollars to maintain a lavish New York home. Well your tax dollars would not be going to support Buz or anyone that receives social security had not the government taken the money that was put into social security and spent it. There should be over 3 trillion dollars in the trust fund when there is only IOU'S from the government. God Bless,"John 5:39 (KJS) Search the scriptures; for in them ye think ye have eternal life: and they are they which testify of me."

|

|||||||||||||||||||||||||||||||||

|

ICANT Member Posts: 6769 From: SSC Joined: Member Rating: 1.6 |

Hi crash,

crashfrog writes: I inserted my name. ICANT writes: Or, both. The only way to fix either is to stop spending more that you take in, or increase the income. So you believe a person can get out of debt making less than they spend. How would you accomplish that? The only way a person can get out of debt is to spend less than their income. If you have no debt as I do then you can spend everything you make if you desire to without adding debt. God Bless,"John 5:39 (KJS) Search the scriptures; for in them ye think ye have eternal life: and they are they which testify of me."

|

|||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined:

|

Do you have any debt? If so you spend more than your income. That's clearly not true. For instance, I can get debt any time I want, but I can only get my paycheck once or twice a month. So, like most people, I may use debt to even out my cash flow despite spending less than my income and maintaining a positive savings rate. In fact that's what most Americans are doing - but, if you average it out over the course of a quarter, hardly any Americans are actually spending more per year than their annual net income. I mean I showed you two different charts that demonstrated that.

6,000 bankruptcies per day is caused by people spending money they did not have and then not being able to procure the money to pay the debt with. Well, sure. But there are many, many more Americans than 6,000. The activities or failures of 6,000 Americans hardly counts as "most." It doesn't even count as "some."

Simple solution is to live within your means. (not spend more than you make) Do you agree or disagree? So people shouldn't take on a mortgage or student loans to pay for college? Even if doing so is likely to earn them much more money in the long run? That makes no sense. Debt is a good thing if used appropriately - to make investments in yourself and your family that will pay for themselves and then some, in the long run. But the year that you buy a home is necessarily a year in which you've "spent more than your income". Should nobody be able to buy a home but the very rich? I can't believe you believe that, or live like that.

There should be over 3 trillion dollars in the trust fund when there is only IOU'S from the government. No, that's incorrect. The Social Security Trust Fund holds government bonds, not IOU's. And what else should it hold? Cash money? That's retarded - interest would destroy it. That's as bad as "saving" your money in a mattress. The SSTF holds government bonds because they grow at a positive net interest rate.

|

|||||||||||||||||||||||||||||||||

|

crashfrog Member (Idle past 1488 days) Posts: 19762 From: Silver Spring, MD Joined: |

So you believe a person can get out of debt making less than they spend. Uh, no. I'm not sure where you're getting that. What I believe is that the government can reduce the deficit by both spending less and raising more revenue. You put it forward as an either/or thing, which makes no sense - the government can do both and reduce the deficit even faster than by doing one thing alone.

The only way a person can get out of debt is to spend less than their income. Well, no, You have to spend the money on paying debt instead of on new consumption. If you just spend less, you stay in debt but your savings grow. But there are two ways to spend more money on paying off debts - increase your income, or spend less on other things. The fastest way to pay off debt is to do both. Generally it's a much better idea to pay off debts than to save money, because the interest rate on your debts is usually much higher than the interest rate any of your savings could earn.

|

|||||||||||||||||||||||||||||||||

|

|

Do Nothing Button

Copyright 2001-2023 by EvC Forum, All Rights Reserved

™ Version 4.2

™ Version 4.2

Innovative software from Qwixotic © 2024